The Day the Dollar Died

August 15, 1971.

The day the dollar as we knew it DIED.

What happened? Who did it? Why was it so important?

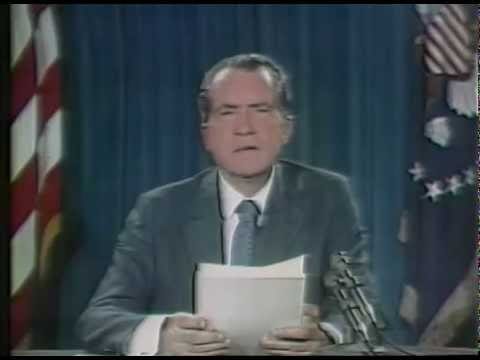

After meeting with 15 economic policy advisors at Camp David from August 13 -15th, 1971 then President Richard Nixon announced his economic plan on national TV to solve three problems:

rising unemployment

rising inflation

deteriorating balance of payments (think of the balance of payments as a country’s “profit” over a given period)

President’s Nixon’s economic plan called for three things:

90-day freeze on wages and prices

10% surcharge on imports to protect American products from exchange rates

Closing the gold window

Closing the gold window, in my opinion, was most influential in shaping today’s financial system.

Why did President Nixon decide to close the gold window?

Before Nixon’s economic plan, the US dollar was redeemable in a fixed amount of gold. You used to be able to go into a bank and exchange your dollars for an ounce of gold.

After World War II, a new monetary system was created in 1944 at the Mount Washington Hotel in Bretton Woods, New Hampshire. This conference, formally known as the United Nations Monetary and Financial Conference would later become known as the Bretton Woods Conference.

730 delegates from 44 Allied nations meet in Bretton Woods to establish a new international monetary system at the end of World War II.

What was key to the Bretton Woods conference was the countries agreed to keep currencies fixed to the dollar with the dollar being fixed to gold.

The dollar truly was as “good as gold.”

With Japan and Europe rebuilding in their postwar economies, the demand for US goods and services and therefore dollars were high. The system seemed secure with the US holding about 75% of the world’s official gold reserves.

But in the 1960’s as Japan and Europe’s exports became more competitive with US exports (along with several other reasons) the supply of dollars increased around the world.

Eventually, more dollars were held in foreign hands than the US had gold.

But with so many dollars in foreign hands what would happen if everyone wanted their gold all at once?

There could be a run on gold!

There would not be enough gold in the US to meet this demand and other countries could lose confidence in the ability of the US to meet its obligations. The US dollar’s position as the world’s reserve currency could also be threatened.

So what was the solution to solve this looming gold run?

End US dollar convertibility to gold.

In other words, the US dollar (and by default the world’s currencies) became a fiat currency. Backed by NOTHING.

Nixon’s speech on August 15th, 1971 was the day the dollar DIED.

The financial system today is a result of this historic speech just over 50 years ago.

Here is the full speech:

Here is the shorter version where Nixon closes the gold window: